Seven years ago I studied Artificial Intelligence (graduate Computer Science courses at Stanford) and a few years later ChatGPT launched, kicking off a generative AI boom. It brought significant change to software development and customer support, though in the financial technology space, where I’ve been leading product teams, use cases were initially limited with only modest impact.

This year, things have started to change: agentic capabilities, including deep, iterative reasoning and external tool use (APIs, calculators, data fetching), allow it to tackle problems of higher complexity, including quantitative ones. With that, more financial use cases are unlocking.

Scanning the market, I look at 9 use cases below.

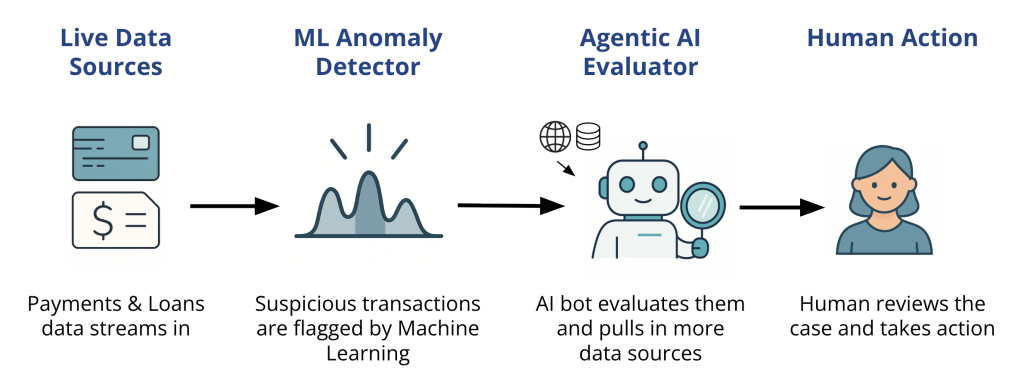

1. Fraud detection

Sifting through data to identify fraud has long been a typical Machine Learning use case. Once suspicious activity is detected however, manual (human) review often follows.

We recently built an agentic AI for payments that combines transaction data with other relevant data and – using a previously manual process – provides a deep qualitative risk evaluation that a human can act on. It’s remarkably successful at identifying complex fraud patterns fast, and has cut human time spent by 80%+. A strong use case.

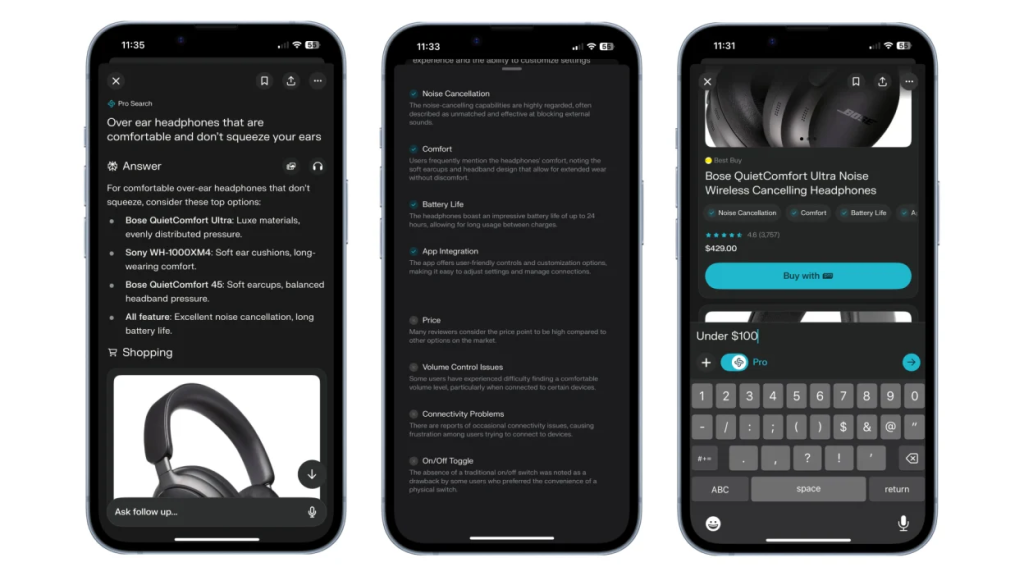

2. Commerce

ChatGPT and competitors are used widely for product research, but the financial part of this journey – checkout – is largely still done by humans.

An AI agent could handle checkout, and companies offering AI models and payments rails are investing by defining standards (ACP by Stripe & OpenAI, TAP by Visa, AP2 by Google, etc.) and creating building blocks. However, the consumer demand for AI taking over checkout is modest, and it requires deliberate adaptation by a large commerce ecosystem (e.g. to support agent identities and payment authorization).

AI will autonomously make purchases in the future, but it’s not quite there yet.

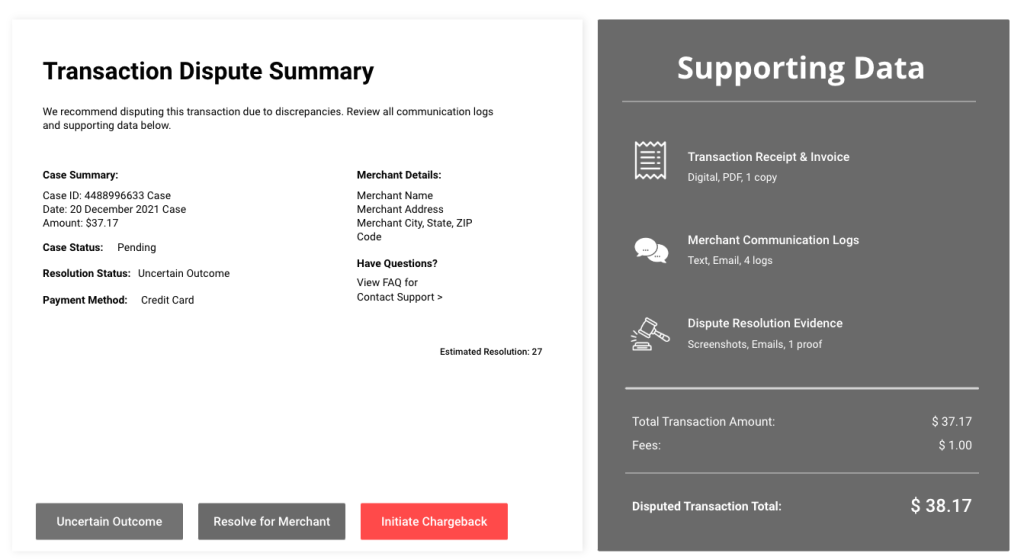

3. Credit card disputes

When a consumer disputes a credit card charge, merchants need to provide evidence that they sold the goods or services as promised. It’s a tedious task where AI is now playing two roles:

- It creates evidence packages for merchants

- It evaluates the evidence for banks & card networks

Helpful on both sides, and this puts us in a place where AI both creates the evidence and evaluates it. What do we need humans for? 🤖🤝🤖

4. Underwriting

At my current company (GoodLeap) we underwrite millions of loans for solar and home efficiency projects. Underwriting consumers for loans (including KYC – Know Your Customer – validation), done by validating structured inputs such as credit history, ID and bank info, often happens fully automated.

When underwriting business partners, the processes can contain more unstructured data: validating non-standard business license documents, ownership histories and online presence can all trigger manual work. More recently, AI is being applied to further automate this process. A human still makes the final call, but more evaluation work is moving to AI.

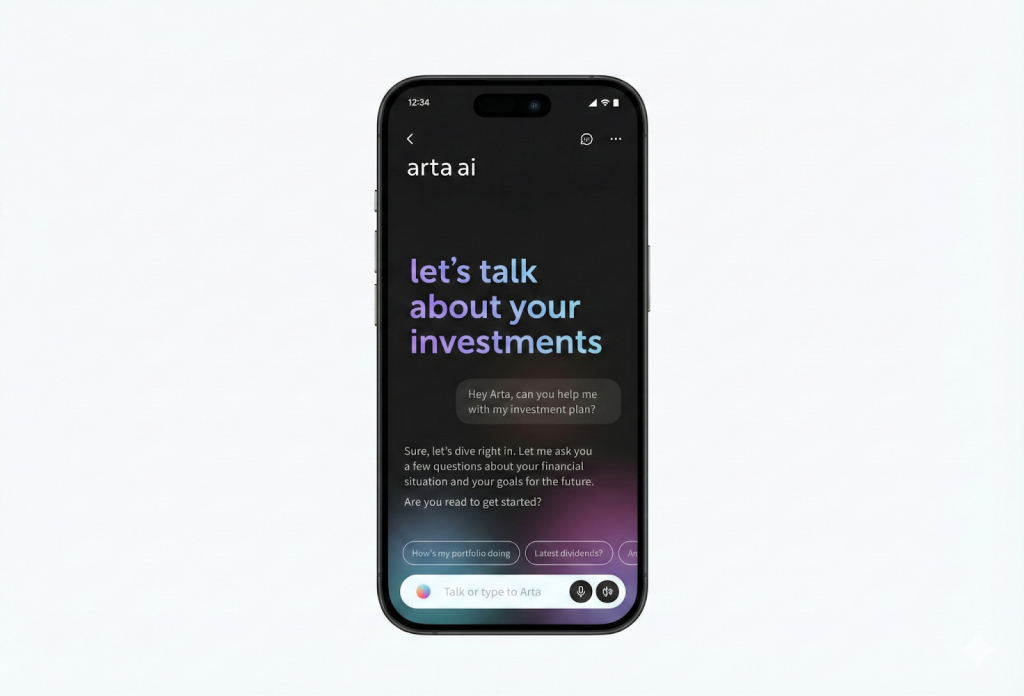

5. Personal wealth management

Robo-advisors have long been part of investing, but generative AI has enabled a new generation of advisory services. An AI model can easily create a highly personalized investment plan, find out how an investment portfolio is exposed to changes in tariffs, or improve its geographic diversity. A clear, helpful use case.

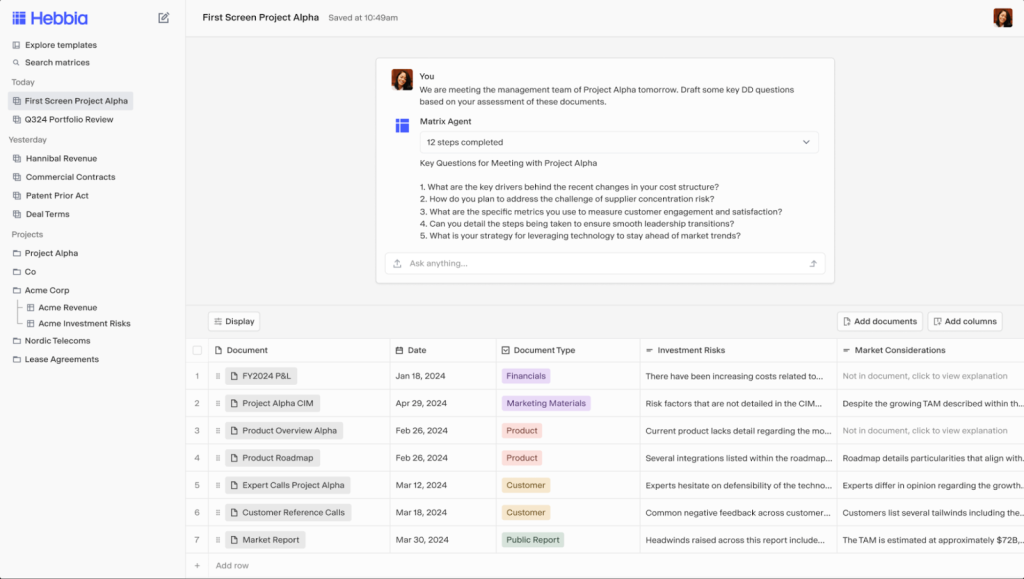

6. Securities research

On the professional investor side, there are holistic AI solutions that help in researching private and public companies. AI runs through earnings reports, legal documents, unstructured data on the internet and more – akin to a group of junior analysts. Friends in this space tell me such solutions can significantly speed up research work.

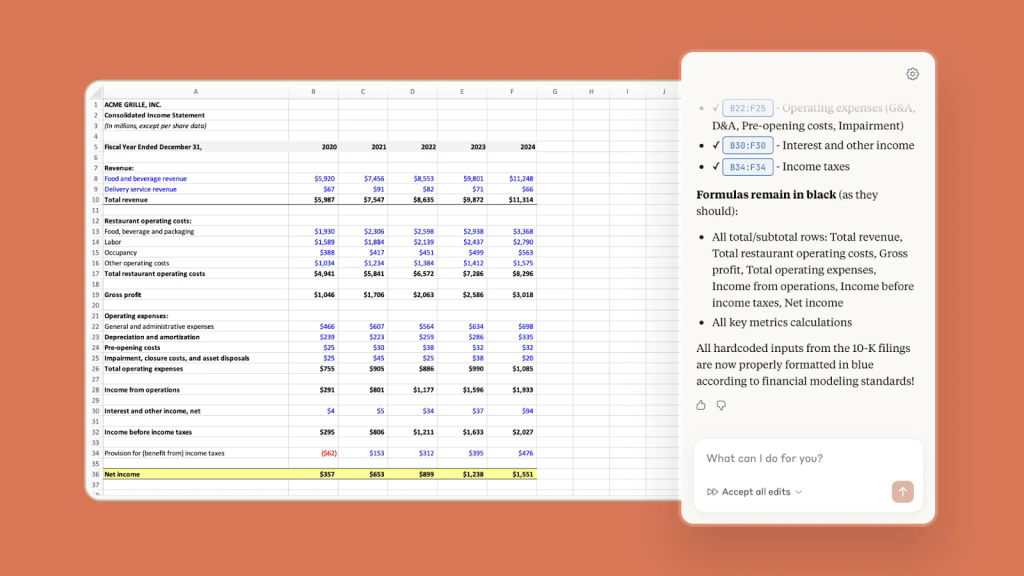

7. Financial modeling

Back when I worked as a financial analyst, I used R (statistical programming language) for complex analysis, but day-to-day financial modeling was done in spreadsheets – flexible & capable.

Financial modeling is labor-intensive. GenAI solutions exist, but they struggle to understand complex spreadsheets and output can be hard to validate, disqualifying when accuracy is critical. For example, Claude for Excel (ETA 2026) is promising, but limited: it can’t handle basics like pivot tables or conditional formatting.

This points at the weak spots of LLM foundations: spreadsheet graphs are quite unlike language – the core of LLMs – and training data is hard to get by, as virtually all financial models are privately held within organizations. A harder skill for LLMs to learn.

8. Tax

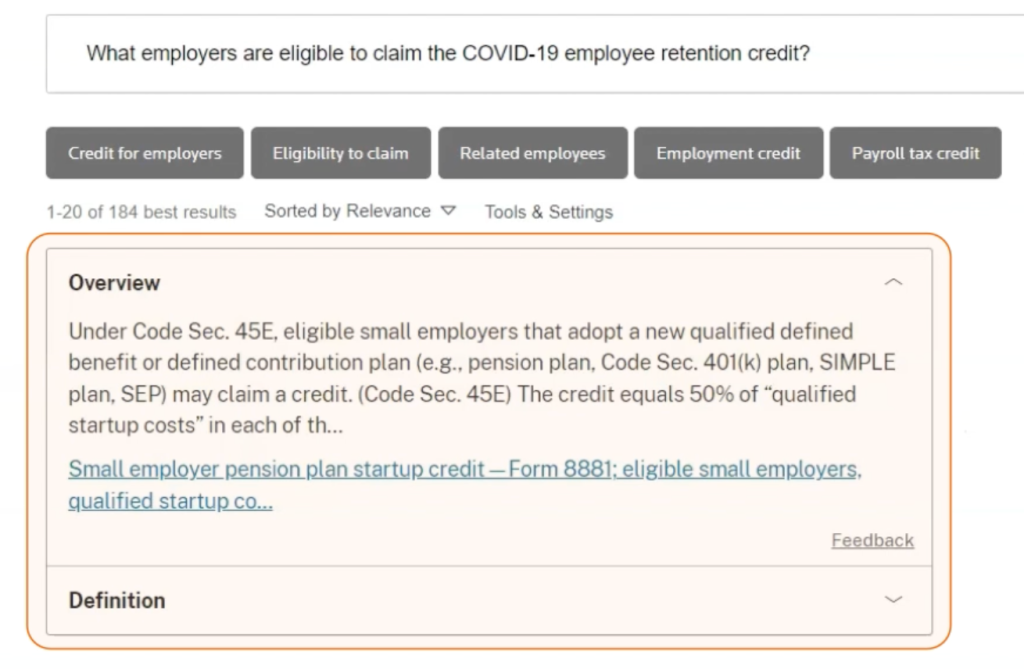

My dad was a tax professional (professor + law firm owner), so as a true rebellious son, there are few topics I dislike as much. Luckily, AI is solving things.

At its heart tax is a semi-structured data problem: it requires understanding of complex, evolving law and regulation, which is then applied to a personal or corporate context. A clear genAI use case, and we indeed see genAI acting as copilot to individuals and tax professionals, the latter group (including my own tax advisor) reporting to use it for research, data ingestion and communication. However, due to legal & financial sensitivity, humans do remain closely in the loop in all steps.

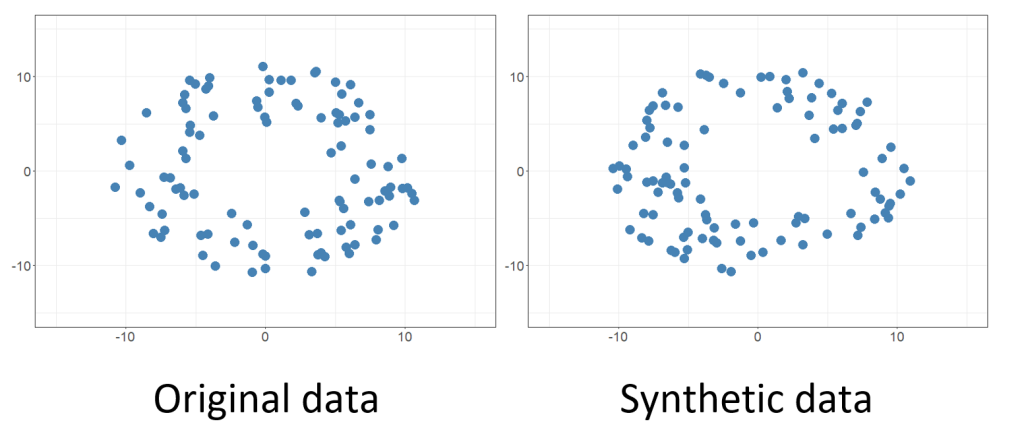

9. Synthetic data

Financial data – such as personal transactions or loans – is sensitive, which can make it hard to use it for e.g. internal software testing.

This is where synthetic data helps: using a real data source as model, synthetic financial data can be created that looks like real data (similar quantitative distributions, names, customer profiles, pictures, and other metadata), while being fully safe to use in testing, speeding up product development.

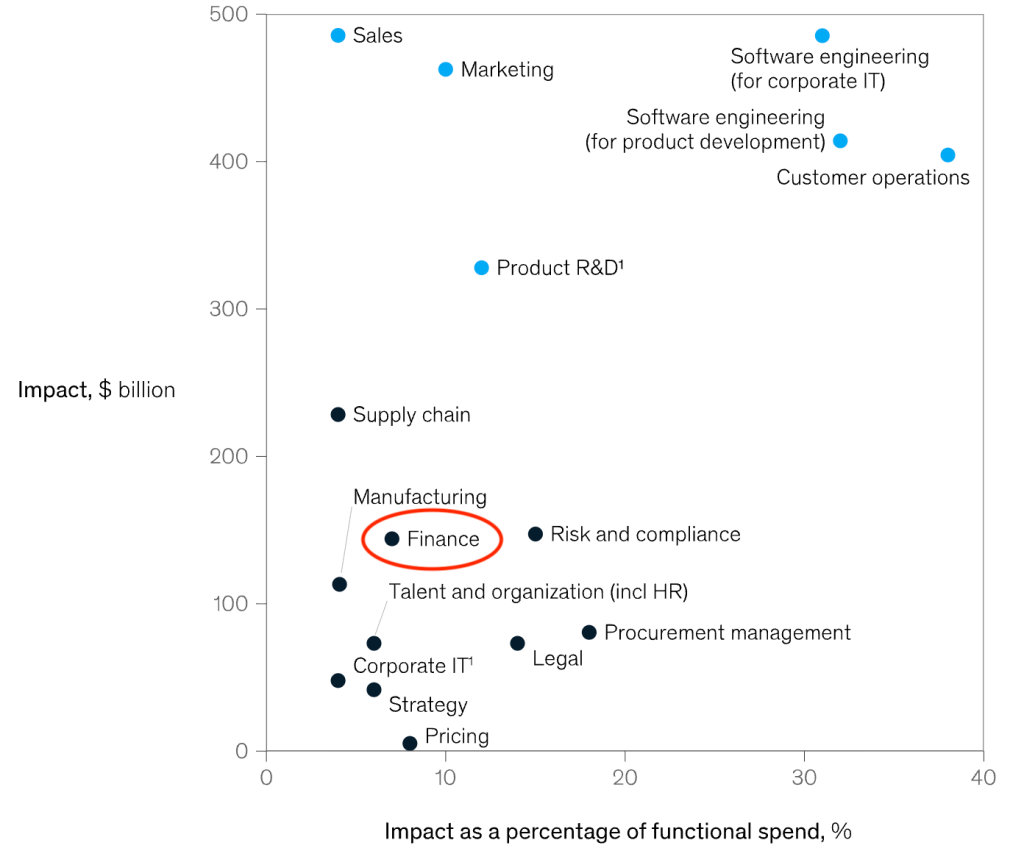

Generative AI’s future in Fintech

The quantitative nature of financial topics (not the core capability of large language models) and sensitive nature of some financial areas (from a regulatory and personal information perspective, as well as the high impact of factual error) initially made generative AI an imperfect fit for Fintech.

But this is starting to change. Agentic capabilities now allow complex problems to be tackled with a high level of accuracy. Solutions for handling sensitive financial data emerge, agents slowly gain ability to make financial transactions, and in many cases agentic interfaces are becoming the primary research UI used by financial professionals & consumers.

| Early generative AI | Next wave agentic AI |

|---|---|

| High rate of factual errors | Multi-step validation allows higher accuracy than top financial professionals |

| Limited quantitative skills | Natively integrated with quantitative financial tools & methods |

| Lack of guardrails for sensitive data | Multiple layers of sensitive financial data protection |

| Chatbot used as writing companion | Agent used as autonomous financial researcher |

| No ability to transact | Agents actively operate in commercial ecosystem |

Generative AI provides most value today where data is unstructured and financial risk is moderate (fraud review, financial research, payment disputes). It’s still a bit weaker where structured data + precision are key (spreadsheet modelling, tax submission), or where full ecosystems need to adapt to it (commerce checkout), though change is coming fast.

It has taken a while for generative AI to take hold in financial processes, jobs and products. But meaningful impact has arrived. Expect progress to accelerate.